This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

CORPORATE Governance

Chairman’s Introduction

“Good governance has always been of fundamental importance to building and sustaining stakeholder value in CAML over the longer term. We continue to develop our implementation of this key principle taking account of the strategy for the business.

“Given the size and nature of Central Asia Metals Plc (“the Company”) or “CAML” the Board has adopted and applies the QCA Corporate Governance Code for Small and Mid-Size Quoted Companies (the “QCA Code”) and has incorporated a set of robust principles based on its guidelines into our corporate governance procedures. The Directors believe this reinforces the strong corporate governance systems and processes that are vital in building a successful business, maximising value and maintaining the high standards that we set for ourselves.

“In structuring its governance framework, CAML takes guidance from the principles of the QCA Code. The Board is supported by four principal Committees, specifically the Sustainability, Audit, Nomination, and Remuneration Committees. These standing Committees focus on the four areas of the Group’s operations which the Board views as having key importance to the Group’s shareholders and other stakeholders.

Our governance arrangements are summarised below:

A strong independent representation on the Board with five independent Non-Executive Directors, supported by its four principal Committees:

- Although not a QCA Code requirement, we have a Sustainability Committee, chaired by Dr Gillian Davidson. This Committee comprises Executive and Non-Executive Directors and closely involves members of the senior management team, including our Sustainability Director. The Sustainability Committee enables us to maintain our strong focus on our people, their health and safety, environmental matters, and the local communities in which we operate. The Committee is responsible for the review of the Group’s corporate ESG performance, in particular, in relation to governance.

- An Audit Committee consisting of three independent Non-Executive Directors and led by David Swan as its Chairman. The Audit Committee assists the Board in its oversight of the Company’s financial reporting, regulatory compliance, and internal control. It also oversees risk management, including receiving reports from management on key business, operational and sustainability risks. In addition, the Audit Committee reviews, on a regular basis, the independence, objectivity, and effectiveness of the external auditor.

- A Nomination Committee is chaired by me, Nick Clarke. The members of this Committee are our other five Non-Executive Directors. The Nomination Committee leads the process and makes recommendations to the Board in relation to Director appointments. It also reviews the composition and structure of the Board with regard to Director independence, and evaluates the balance of skills, strengths, diversity, knowledge, experience and tenure of the Directors. The Committee reports on the annual internal review process for evaluating the Board’s performance and effectiveness and assists the Board with its progressive refreshment and ongoing succession planning.

- A Remuneration Committee led by Mike Prentis comprising solely independent Non-Executive Directors. The Remuneration Committee determines the remuneration of our Executive Directors, oversees the remuneration of our senior management, and approves awards under the Company’s Long-Term Incentive Plan. In doing so, it ensures our incentive schemes are aligned with our business and sustainability priorities.

“The four principal Committees as described above support the Board in ensuring the relevant level of focus on their specific areas of responsibility and each have their own terms of reference which provide the necessary authorities for them to operate as they consider appropriate. Each Committee reports to the Board through its respective Chair, providing invaluable contributions to the Board’s effectiveness through their work.

“In 2022, in addition to the four principal Committees, we have also established a Technical Committee to assist the Board in its review of major projects and an Advisory Committee through which the Board can access the historical knowledge of former Directors and senior managers who have retired from the Group.

“The QCA Code consists of ten principles that promote medium to long-term value for shareholders and other stakeholders, building on the enterprising spirit in which CAML was created and continues to operate today. The ways in which CAML has applied the QCA Code are detailed below and annual updates on our compliance with the QCA Code will be provided.”

NICK CLARKE, CHAIRMAN

PRINCIPLE 1. ESTABLISH A STRATEGY AND BUSINESS MODEL WHICH PROMOTE LONG-TERM VALUE FOR SHAREHOLDERS

The Board works as a cohesive team paying keen attention to the Company’s purpose and strategy of long-term growth for shareholders and other stakeholders.

The Company generates value for its shareholders through the mining and extraction of saleable metal products at its two sites, Kounrad, the copper operation based in Kazakhstan and at Sasa, the zinc, lead, and silver mine based in North Macedonia. The Company also seeks to generate value through the identification of accretive business development opportunities.

CAML’s purpose as a diversified resources company is to produce base metals essential for modern living, profitability in a safe and sustainable environment for all our stakeholders. The immediate strategic objectives of sustainability, low costs and high margins, and prudent capital allocation are underpinned by longer-term ambition of growth through acquisition.

CAML benefitted from elevated metal prices in early 2022, however, these prices began to respond to greater economic uncertainty towards the end of the year. So, the Company continued to focus on maximising value from Sasa and Kounrad and believes that this has been achieved to date. Operations will continue to be optimised going forward with a focus on maintaining low cash costs of operation and undertaking the required capital programmes to ensure safe and sustainable operations for the long term. Kounrad 2022 copper production again exceeded guidance and Sasa 2022 production was solid. The Company ended 2022 with a strong balance sheet, having made the final payment on its corporate debt facility in August.

The aim is to strike the right balance for shareholders in terms of capital allocation. The Company has become known for continuing to pay sector leading dividends and remains mindful of the challenges of scale and liquidity so keeps a watchful eye on potential growth opportunities. The Company has delivered shareholder returns of $299.0 million since 2012.

At Kounrad, there are approximately 111,600 tonnes of recoverable copper, which should ensure a life of operation to 2034. Sasa has probable reserves and inferred resources to support the operation until 2039.

A summary of the Company’s strategic objectives can be found on page 19-25 of the 2022 Annual Report.

PRINCIPLE 2. SEEK TO UNDERSTAND AND MEET SHAREHOLDER NEEDS AND EXPECTATIONS

The Board is cognisant of the expectations of all elements of the Company’s shareholder base. We have embedded into our culture as a Group that maintaining a continual, open and active dialogue with our shareholders and other stakeholders plays an essential part in understanding their views and ensuring the long-term success of the Company.

It is important that our shareholders and other stakeholders have clear points of contact when seeking to engage with the Company. During 2022 we strengthened our shareholder liaisons with the introduction of new roles to enhance this area. Following the Company’s 2022 Annual General Meeting (‘AGM’) in May, Louise Wrathall, our Director of Corporate Relations was appointed to the Board as an Executive Director responsible for Corporate Development. We believe Louise’s appointment further enhances the skills of the Board, emphasising the importance we place on her areas of responsibility, including investor relations, business development and environmental, social and governance (‘ESG’). Whilst most contact with the Company’s institutional investors is with the Executive Directors, valuable feedback from shareholders and other stakeholders is also communicated to, and discussed with, the other Board members. To strengthen this link with the Board further, also following the 2022 AGM, we appointed Mike Prentis in the new role of Senior Independent Director. In this role Mike will also be available as an additional point of contact for shareholders. Finally, we created a new role, Group Investor Relations Manager to support the Director of Corporate Development, responsible for investor relations and external communications.

The Board as a whole recognises that the views of our investors should be considered as an important part of the Board’s deliberations and decision-making processes as the Board has a duty to safeguard the interests of all stakeholders. As well as the shareholder liaison contacts mentioned above, the other Directors are also available to meet with investors where requested and all shareholders also have the opportunity to attend and ask questions at the Company’s Annual General Meeting or to submit questions in advance of the meeting by email. The Board welcomes the opportunity to understand the motivations behind voting decisions, as well as the ongoing feedback from our shareholders and other stakeholders, as this plays an important part in ensuring our long-term success and, as a Company, we continue to explore new ways to engage with them. At the 2022 AGM, for the first time, shareholders and others were able to watch the proceedings of the AGM via the online platform Investor Meet Company and immediately following the AGM, a management presentation on the Group and its business was also broadcast. Questions submitted in relation to this presentation and the business generally were then answered following the presentation. We followed this successful meeting format again this year for the 2023 AGM and were pleased to welcome shareholders to our meeting both in person and online via the Investor Meet Company platform.

Material information in relation to the Company is made publicly available via the London Stock Exchange’s Regulatory News Service (RNS). Presentations on our full year and interim results are given to analysts and investors shortly after publication.

Where appropriate, we engage with our key shareholders on specific governance matters. Details of this, and our other stakeholder engagement activities during 2022, are set out in the table on page 78 of the 2022 Annual Report.

PRINCIPLE 3. TAKE INTO ACCOUNT WIDER STAKEHOLDER AND SOCIAL RESPONSIBILITIES AND THEIR IMPLICATIONS FOR LONG-TERM SUCCESS

The Board and its Committees consider the potential impact of decisions on relevant stakeholders whilst also having regard to a number of broader factors, including the need to foster the Company’s business relationships with suppliers, customers and others. Particular consideration is given to the impact of the Company’s operations on the community and environment, responsible business practices and the likely consequences of decisions in the long term.

Examples of this can be seen in the long-term planning for the operation of the Group’s key assets in Kazakhstan and North Macedonia, ensuring that this process continues to take account of the interests and views of our stakeholder groups. By careful consideration of these factors, we believe that we can create positive benefits for our stakeholders, which are integrated into our strategic model, that are also in the interests of the Company and its members. Further details and examples of this approach at work are set out in the s172 statement on pages 33-35 of the 2022 Annual Report. In this statement we identify each of our key stakeholder groups, give an overview of how we engage with them, and the issues raised through this engagement. In particular, the Sustainability Committee supports the Board as it seeks to build good relationships with stakeholders including workforce, local communities, investors, suppliers and customers, NGOs and governments and continuously aims to understand their needs, interests and expectations recognising this plays an essential part in ensuring the long-term success of the Company. Where appropriate we implement the findings of this invaluable engagement and take feedback into consideration in our decision-making process. Board members are also available to answer shareholder questions at the Annual General Meeting and at other times whenever required. During 2022 we undertook management meetings with major investors which focused around the Company’s sustainability matters. Feedback from investors from these meetings identified areas that were either already being handled by the Company or plans were being progressed to implement the changes. Details of stakeholder engagement activities during 2022 can be found on page 78 of the 2022 Annual Report.

As mentioned above, our Sustainability Committee plays a very important role in assisting and supporting the Board in its stakeholder relations by ensuring that its strong sustainability foundations are integrated into, and aligned with, the Company’s strategy. As a Company, one of our core values is our responsibility for sustainable development and we endeavour to ensure this is fully integrated within our operations.

This Sustainability Committee comprises Executive and Non-Executive Directors: Dr Gillian Davidson (Chair), Dr Mike Armitage, Roger Davey and Nigel Robinson from the UK. This ensures a full breadth of perspectives are brought to the Committee’s important and varied activities. Given the importance that the Board places in this area, the Sustainability Committee meets on a regular basis throughout the year. It considers and regularly reports to the Board in relation to ethical matters, such as, health and safety, environmental matters and local community projects where CAML places a strong focus on health and education in partnership with local organisations. The Committee also receives presentations from members of operational management as appropriate and the Sustainability Committee liaises closely with the Sustainability Director to ensure that the Board is updated on matters from every meeting.

Our 2022 Sustainability Report was published in Q2 2023 and is available on the Company’s website. This provides a comprehensive overview of our ongoing sustainability approach. In the past year we re-visited CAML’s material sustainability topics through an independent stakeholder engagement process and findings from this will shape our future Sustainability Report publications. We are proud of the Group’s accomplishments to date in terms of sustainability, particularly in relation to our ongoing partnership with the communities in which we work. A more detailed summary of sustainability matters in the Group is given in on pages 26 to 29 of the 2022 Annual Report and, as mentioned above, in our separate Sustainability Report.

PRINCIPLE 4. EMBED EFFECTIVE RISK MANAGEMENT, CONSIDERING BOTH OPPORTUNITIES AND THREATS, THROUGHOUT THE ORGANISATION

The Board has ultimate responsibility for risk management. The Audit Committee assists by monitoring this key area on behalf of the Board, including overseeing the activities of the Group Risk Committee. The Group Risk Committee, comprising senior executive management, is responsible for managing risk within the Group for the Audit Committee and meets on a quarterly basis.

During the year, as well as regular scheduled Audit Committee meetings, an additional risk focussed meeting was held to ensure this critical area received the necessary time and attention required. At this risk-specific meeting, the Audit Committee conducted an in-depth review of the Group’s principal risks and progress of risk mitigation measures, including new and emerging risks, and revisited the risk reporting framework in the Group.

The Group Risk and Internal Control Manager attends the quarterly meetings of the Group Risk Committee and any risk-specific Audit Committee meetings to ensure continuity between the work of the Group Risk Committee and the Audit Committee. The Group Risk and Internal Control Manager and other Group Risk Committee members report on progress to the Audit Committee towards an efficient and effective management of the risks which are relevant to the Group’s business.

The Group Risk Committee meets regularly and ensures that risk management is addressed in an orderly and systematic way and that key risks identified are brought to the attention of the Audit Committee. The Audit Committee actively reviews the risk register and assesses the actions being taken by senior management to monitor and mitigate the risks. Management is responsible for taking particularly significant risks, as appropriate, to the Board which are then considered under a standing agenda item at each main Board meeting. How we identify and manage risks can be found on pages 53 to 66 of the 2022 Annual Report. This includes CAML’s risk management process and its framework, our risk appetite, updates on principal risks and uncertainties and emerging risks such as the conflict in Ukraine. During the year, ‘People’ was elevated to the list of principal risks as succession planning for key positions across the Group was recognised as one of the key elements within this risk category. The Committee will work with the Board and the Nomination Committee where work is already underway in this critical area.

The conflict in Ukraine was identified as an emerging risk and, during 2022, its impact on the global economy and on CAML became more apparent. The uncertainty of the conflict’s resolution and timeline raised geopolitical risk to an unprecedented level. The indirect consequences of the conflict such as the energy crisis, expanding sanctions regime, historically high inflation and others have been considered when assessing and putting mitigating measures in place for related principal risks.

In conjunction with Risk Management, the Audit Committee also monitors and reviews the effectiveness of the Group’s internal control systems. Key elements within the internal control structure are summarised as follows:

- The Board and management – the executive members of the Board are responsible for overseeing the day-to-day management of the Company.

- Budgeting – there is an annual budgeting process whereby budgets for each upcoming financial year are reviewed by the Audit Committee and recommended to the full Board. The budgets as well as the annual budgeting process itself are kept under review by the Audit Committee.

- Long-term forecasts and underlying assumptions – the Audit Committee ensures these are properly reported to, and reviewed by, the Board on a regular basis.

- Management reporting – the financial performance of the Group is monitored against budget on a monthly basis and reported to the Board once a quarter.

- Operating controls – such controls are in accordance with Group policies and include management authorisation processes.

- Monitoring – the effectiveness of the system of internal control is monitored regularly through internal reviews and external audits by both auditors and other consultants as required. In addition, to enhance our processes in this crucial area, during 2021 we appointed a dedicated Group risk and internal controls manager.

PRINCIPLE 5. MAINTAIN THE BOARD AS A WELL-FUNCTIONING, BALANCED TEAM LED BY THE CHAIR

The Board of Directors, led by the Non-Executive Chairman, Nick Clarke, defines the purpose of the Company, and makes key decisions about strategy, financial planning, review of financial performance, setting the cultural tone for the Group and ensuring its values are upheld, its Directors and its operations. The Board considers this role as critical to leading the Group to maximise success in its business, and to the Company in delivering value to shareholders and other stakeholders. The Board also recognises that it has a collective responsibility and legal obligation to promote the interests of the Company, including being collectively responsible for defining corporate governance arrangements.

The Chairman leads on governance matters actively seeking input from the other Non-Executive Directors where appropriate.

We have a diverse Board, constituted as follows:

- Non-Executive Chairman, Nick Clarke

- Three Executive Directors: Nigel Robinson, Gavin Ferrar and Louise Wrathall

- Five Non-Executive Directors who are all considered fully independent: Dr Mike Armitage, Dr Gillian Davidson, Mike Prentis, David Swan, and Roger Davey.

- Our Board offers a wealth of expertise and wide range of experience in the mining industry, in financial and operational aspects of businesses, in public markets and in operating across different geographies around the world

During the year, the Board considered the independence of each Director, including assessment of their character, judgement, length of tenure, any business and other relationships which could materially interfere with the exercise of their judgement or their ability to effectively discharge their duties. After taking account of all of these factors, the Board continues to consider Dr Mike Armitage, Dr Gillian Davidson, Roger Davey, Mike Prentis and David Swan to be independent Directors.

The Board believes the Independent Non-Executive Directors along with our three Executive Directors provides an excellent balance of views, skills, personal qualities and depth of experience within the Board.

All Directors devote ample time in order to discharge their duties both at and outside of Board meetings. Board and Committee meetings normally take place over the course of one or two days. At these meetings, strategy-specific matters in the Group are a regular area of focus and one meeting a year is entirely devoted to this area to allow adequate time for matters to be fully considered. Board meetings are also attended by local operational management as appropriate. In addition, Non-Executive as well as Executive Directors visit the Group’s operations when opportunities to do so arise. In June 2022, the Board, as well as members of senior management, visited our operations in North Macedonia and in October 2022 and April 2023, the Technical Committee also visited Sasa. A Board trip to visit operations on site in Kazakhstan took place in July 2023.

Our Board meets at least five times a year and at other times where required for arising matters. During 2022 we returned to fully in-person Board and Committee meetings, having used a combination of video-conference and face-to-face meetings in the prior year. The virtual meeting format has been increasingly helpful to the Company in recent years, with improvements in technology allowing efficient meetings to take place over video and, although this cannot fully replace in-person interactions, the ability to increase meeting frequency, particularly in dealing with critical or urgent matters, has been greatly beneficial to the Board’s effectiveness. Whilst our scheduled Board meetings have now reverted back to the preferred face-to-face format, virtual meetings will continue to be utilised when additional or short-notice Board meetings are required.

During 2022, in addition to the five main Board meetings held, we also held an additional Board update meeting to consider specific matters. As well as the Executive Directors, senior management are invited to attend and present at meetings of the Board and its Committees where appropriate.

Details of Directors’ attendance at each of the scheduled meetings of the Board and its Committees for the 2022 financial year can be found in the Board Report on page 75 of the 2022 Annual Report.

The Board is well briefed in advance of meetings and receives high-quality, comprehensive reports to ensure matters can be given thorough consideration. There is an appropriate balance of influence within the Board which, as a result, is not dominated by one person or group of individuals. The Independent Non-Executive Directors constructively challenge the Executive Directors and the resulting Board debates are always robust and sometimes lively. The open and direct forum for discussion ensures the deliberations during meetings lead to decisions reached by the Board collectively in alignment with the core values of the Company.

In line with the QCA Code and as already mentioned, the Board is supported by Committees, specifically, Sustainability, Remuneration, Nomination and Audit Committees covering four of the areas of the Group’s operation which the Board views as having key importance to the Group’s stakeholders. Each of these Committees has their own terms of reference which provide the necessary authorities for them to operate as they consider appropriate. Each of these Committees reports to the Board and provides great value to its effectiveness.

In addition to the four principal Committees mentioned above, the Board also benefits from the expertise and guidance provided by our additional Technical and Advisory Committees established during 2022. The Technical Committee assist the Board in its review of major projects and the Advisory Committee gives access to the historical knowledge and perspectives of former Directors and senior managers who have retired from the Group.

PRINCIPLE 6. ENSURE THAT THE DIRECTORS HAVE THE NECESSARY UP-TO-DATE EXPERIENCE, SKILLS AND CAPABILITIES ACROSS THE BOARD

The Board is comprised of a diverse group of experienced Directors, both from the UK and abroad, each with a wealth of expertise and a depth of knowledge. Many have worked across a variety of jurisdictions and have extensive business and financial experience in the sector in which the Group operates. This ensures that each member of the Board is able to fully contribute to the effectiveness of the Board as a whole and in doing so, have collective responsibility for promotion of the interests of the Company, participation in its decision making and the definition and setting of its governance arrangements. We believe this leads to better performance, sustainable growth and value in the business for its shareholders and other stakeholders in the long term.

The Board has an appropriate balance of skills and draws on each Director’s unique skillset, personal attributes and wide range of experience in the mining industry, financial and operational aspects of businesses, public markets and of different geographies around the world. For further information on the key strengths, composition and diversity of the Board, see pages 74, 76 and 87 respectively of the 2022 Annual Report.

Biographical details of the Directors on the Board can be found on: About – Directors and on pages 76-77 of the 2022 Annual Report.

On appointment to the Board, a new Director receives a comprehensive induction to familiarise themselves with the Company and its business. All Directors have unrestricted access to, and receive regular updates from management which enables them to keep abreast of latest developments. Directors have ongoing access to resources as appropriate for the update of their skills and knowledge.

Our most recently appointed Executive Director, Louise Wrathall shared with us her experience transitioning from senior management to the Board of the Company. This Q&A is set out on page 89 of the 2022 Annual Report.

All Directors on the Board also have access to the Company Secretary who acts as secretary of the Board and its Committees, reporting directly to the respective Chairs in ensuring appropriate governance procedures are followed.

All Directors are also able to seek advice from the Company’s external advisors if they wish. The role of the Auditors is explained in more detail in the Audit Committee Report on pages 83-85 of the 2022 Annual Report.

PRINCIPLE 7. EVALUATE BOARD PERFORMANCE BASED ON CLEAR AND RELEVANT OBJECTIVES, SEEKING CONTINUOUS IMPROVEMENT

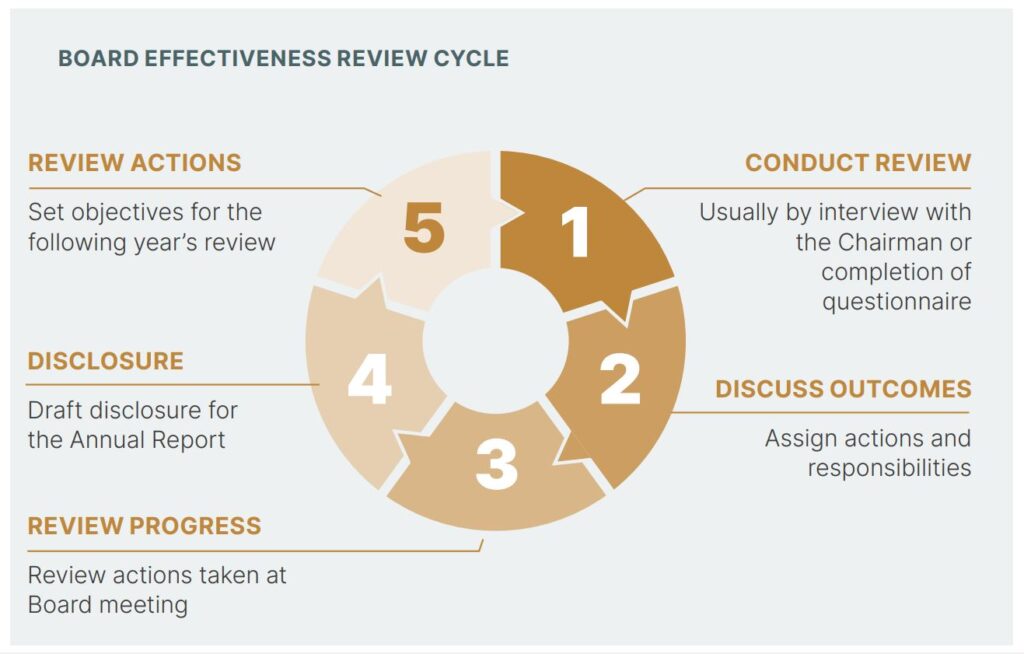

In line with the QCA code, since our first internal effectiveness review was carried out in 2018, the Nomination Committee, led by Nick Clarke as Chairman has completed internal evaluations of the effectiveness of the Board on an annual basis. These reviews consider the effectiveness of the Board as a unit, its Committees and of the individual Directors, including the Chairman. In doing so, each year we have also taken into account the outcomes of the previous year’s review. In 2022 we undertook an enhanced review of progress against previously agreed actions arising from our 2021 effectiveness review. This ensured we were able to track actions taken in areas identified for improvement through to their conclusion and report on those outcomes. It also allowed us to set objectives and identify areas for continued focus in the coming year. We believe the evaluation process should continually evolve and as implementation of actions resulting from this process can often span more than one year, this cycle varies as appropriate to accommodate this. Following this pattern also ensures the process remains fresh and effective.

The diagram below shows the cycle of our internal effectiveness review:

The areas of focus arising from the 2021 evaluation and actions taken in 2022 in response to these are shown in the table on page 90 of the 2022 Annual Report.

The Nomination Committee assesses the developing needs of the Company regularly and on an ongoing basis, not just in relation to the periodic refreshment of the Board, but also to ensure contingency plans are in place for unexpected changes, in addition to those being planned for the longer-term, both at, and below, Board level. The Board evaluates and keeps under review its composition and balance of skills and experience, in particular with regard to the emerging trends and key areas of focus in the sector in which the Group operates. Particular attention is given to this area in our annual Board evaluation process and taken into consideration for appointments to the Board..

The Nomination Committee is responsible for making recommendations to the Board regarding the appointment and re-election of Directors and the membership of the Board’s Committees where appropriate. During 2022, we continued with our progressive succession plans as Bob Cathery, one of our longer-serving Directors, retired from the Board at the Company’s 2022 AGM following a transition of his role as Remuneration Committee Chairman to Mike Prentis. At the same time, Mike also stepped into the newly created role of Senior Independent Director. Though not an AIM requirement, as part of the continuing evolution of the Company and responsibilities of our Board members, we felt it appropriate to further develop the structure of the Board as well as giving our investors an additional point of contact should they wish this. As mentioned previously, Louise Wrathall was appointed to the Board as Director of Corporate Development at the conclusion of our 2022 AGM and provides a valuable additional Executive perspective in the Board’s deliberations.

Following the Board changes during the year, the Nomination Committee undertook an in-depth succession planning and developmental discussion in relation to the Board and the long term. The focus of this discussion was to outline plans to maintain both continuity and progression over the coming years and into the longer term, ensuring the appropriate balance between these two key aspects of succession planning. This should enable the continued retention and recruitment of high- calibre staff as appropriate.

Following this phase of progressive succession, we have also refreshed our Committee memberships, ensuring we continue to utilise the skills and experience of each of our Directors in the best way possible, maximising their contributions to the operation of the Board and its Committees. Details of the current Committee memberships are set out on pages 71-72 of the 2022 Annual Report.

As mentioned previously, we believe ongoing succession planning below Board level is also of particular importance. Key areas of focus for 2023 will continue to be succession planning for existing resource, talent development and increased emphasis on people, recognising that people are critical to the continued long-term success of the business.

A future area we intend to address as part of implementation of our succession plans relates to the role of Chair of the Audit Committee. We are pleased that David Swan has agreed to continue in this role, and the Board remains fully satisfied with regard to his independence as a Director. Given the importance of this role and the long business and project cycles within which the Group operates and reports on, we intend to ensure that a transition is fully complete before any change is finalised.

PRINCIPLE 8. PROMOTE A CORPORATE CULTURE THAT IS BASED ON ETHICAL VALUES AND BEHAVIOURS

Commitment to good corporate governance in the boardroom is just one part of setting and maintaining an appropriate culture that aligns with our purpose, strategic goals and values.

The Board and its Committees set the tone for, and promote a healthy culture of, openness, honesty, engagement and respect throughout the Group and with all of its stakeholders. The Board welcomes an open dialogue with all stakeholders, be they investors, employees, governmental authorities or local communities. Decisions made by the Board collectively, supported by management, are taken in the context of this shared sense of purpose that comes with the continuous focus on culture throughout the Group’s operations. We highlight the importance of communication and the flow of information throughout the Group to ensure consistency in our procedures. Our Group People Manager regularly undertakes exercises on site to revisit the Company’s values ensuring these align with our Group commitments. We also maintain strong internal policies including those relating to anti-bribery, trade sanction, share-dealing, the Modern Slavery Act, human rights, our code of conduct and whistleblowing which are implemented by our teams and regularly reviewed.

These policies are available here: Company Policies. The Board promotes the corporate culture of the Group with the support of the Sustainability Committee.

PRINCIPLE 9. MAINTAIN GOVERNANCE STRUCTURES AND PROCESSES THAT ARE FIT FOR PURPOSE AND SUPPORT GOOD DECISION-MAKING BY THE BOARD

As well as the Non-Executive Chairman and three Executive Directors, there are five independent Non-Executive Directors on the Board. In line with the QCA Code, the Board is supported by the Remuneration, Nomination and Audit Committees. Although not a QCA Code requirement, the Company’s governance structure also includes a Sustainability Committee. The Board is further supported by its additional Technical and Advisory Committees. Further details on the roles of each of these Committees are set out in the Governance Report commencing on page 68 of the 2022 Annual Report.

The Board takes corporate governance very seriously and is committed to ensuring that its procedures are robust, kept up to date and appropriate for a company of its size. The Board reviews its procedures periodically to ensure that they evolve as the business grows. The Board’s Committees assist the Board in ensuring the relevant level of focus on their specific areas of responsibility and each have their own terms of reference which provide the necessary authorities for them to operate as they consider appropriate. The terms of reference for each of the Committees are available here: Committees.

PRINCIPLE 10. COMMUNICATE HOW THE COMPANY IS GOVERNED AND IS PERFORMING BY MAINTAINING A DIALOGUE WITH SHAREHOLDERS AND OTHER RELEVANT STAKEHOLDERS

As explained under Principles 2 and 8 above, we have embedded into our culture as a Group, through our communications, reporting and governance structures, that maintaining a continual, open and active dialogue with all of our shareholders and other stakeholders plays an essential part in building a mutual understanding of views and ensuring the long-term success of the Company. It is important to us that our stakeholders have clear points of contact when seeking to engage with the Company. Whilst most engagement with the Company’s institutional investors is through the Executive Directors and the Director of Corporate Development, valuable feedback from shareholders is also communicated to, and discussed with, the other Board members. The other Directors are also available to meet with investors on request and all shareholders also have the opportunity to attend and ask questions at the Company’s Annual General Meeting. In addition, our Director of Corporate Development assists in shareholder interaction at the AGM and at other times. To strengthen the structure of the Board further in this area, during 2022 we appointed Mike Prentis in the new role of Senior Independent Director. In this role Mike will also be available as an additional point of contact for shareholders. Given his background and substantial experience as an investor, we felt Mike would be an ideal candidate for this position. We also created a new role, Group Investor Relations Manager, to support the Director of Corporate Development, responsible for investor relations and external communications.

The Board as a whole recognises that the views of our investors should be considered as an important part of the Board’s deliberations and decision-making processes as the Board has a duty to safeguard the interests of all stakeholders. We welcome the opportunity to understand the motivations behind voting decisions, as well as the ongoing feedback from our shareholders and other stakeholders, as this plays an important part in ensuring our long-term success.

See pages 77-78 of the 2022 Annual Report for details on our shareholder engagement and activities in this area during the year. Further details are also set out on pages 33-35 of the 2022 Annual Report in the Company’s Section 172 statement where we identify our key stakeholder groups and describe our engagement with them, issues raised and the outcomes/actions arising from this engagement.

Other stakeholder matters are overseen by a specific Sustainability Committee as described in the principles mentioned above. Further details of the activities of the Sustainability Committee and of the other Board Committees can be found in the Governance Report commencing on page 68 of the 2022 Annual Report.

Historical annual reports and notices of general meetings can be found here: Reports and Presentations.

Updated 20 July 2023